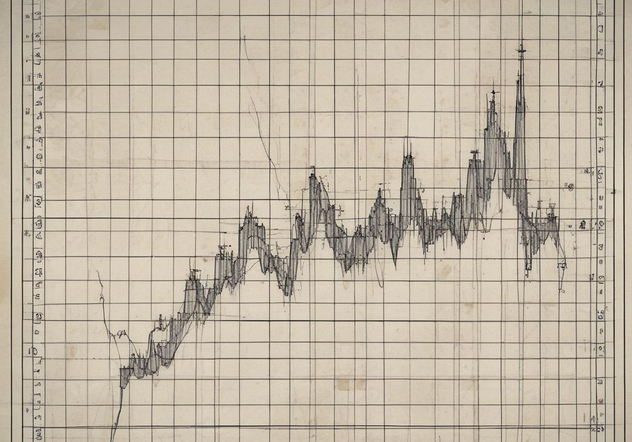

Grid Trading Bots automate buying low and selling high within a set price range, optimizing trading strategies effortlessly.

How Does a Grid Bot Work?

Imagine having a tireless assistant tirelessly analyzing market trends, executing trades, and optimizing profits on your behalf – that’s precisely what a Crypto Grid Trading Bot does. By leveraging sophisticated algorithms, these bots automate the trading process, allowing you to capitalize on market fluctuations without being tethered to your screen.

Crypto Grid Trading Strategy:

Explore a myriad of strategies tailored for crypto grid trading bots, including:

- Trend Following: Ride the waves of market momentum with strategic entries and exits.

- Mean Reversion: Seize opportunities as prices revert to their average levels, maximizing returns.

- Scalping: Execute rapid-fire trades to capitalize on micro price movements, leveraging high volatility.

- Market Making: Dive into continuous buying and selling to profit from spread differentials across exchanges.

- Arbitrage: Exploit price differentials between exchanges, capitalizing on market inefficiencies for profit.

Setting Up the Grid Bot:

Unlock the full potential of your Grid Bot with a seamless setup process:

- Define trading parameters, including entry points, trading volume, and take-profit percentages.

- Utilize technical indicators like Bollinger Bands, RSI, and MACD to refine your strategy.

- Automate trading with precision by integrating stop-loss levels and risk management protocols.

- Leverage free grid trading bots offered by exchanges like OKX and Binance Futures for enhanced efficiency.

Types of Grid Bots:

Dive into the diverse world of Grid Bots tailored to your trading needs:

- Spot Grid Bot: Seamlessly navigate real-time markets with a grid of buy and sell orders, maximizing profit potential in volatile conditions.

- Futures Grid Bot: Unlock the power of futures trading with automated grid strategies, capitalizing on price fluctuations for consistent returns.

Backtesting Strategies:

Harness the power of backtesting to refine your grid trading strategy:

- Simulate past market performance to gauge the effectiveness of your chosen strategy.

- Proceed with caution, recognizing that historical performance may not guarantee future results.

Conclusion:

Empower your crypto trading journey with the unmatched potential of Grid Trading Bots. With expert strategies, seamless setup guidance, and a comprehensive understanding of grid bot variations, you’re poised to dominate the crypto markets and achieve unparalleled success.